Building Supplies Etf

2 iShares US.

Building supplies etf. Updated May 14 2021. The Roundhill Ball Metaverse ETF META ETF is designed to offer investors exposure to the Metaverse by providing investment results that closely correspond before fees and expenses to the performance of the Ball Metaverse Index META Index. Home Construction ETF ITB Anyone trying to buy a home right now may find its tougher than usual especially here where I live in South Florida.

201 rows A list of Building Materials ETFs. 2 iShares US. Infrastructure exchange-traded funds ETFs provide exposure to companies that build and maintain major projects and systems.

Sector ETFs like these can be used as a diversification tool when included in small percentages in a broad diversified portfolio. The fund charges 30 bps in annual fees see all the Materials ETFs here. The Metaverse is defined as a successor to the current.

However investors should keep in mind that investing in narrowly focused sector funds like homebuilders ETFs. The homebuilding industry includes home builders including manufacturers of mobile and prefabricated homes as well as producers sellers and suppliers of building materials furnishings and fixtures. 1 Day NAV Change as of 14Jul2021 -030 -048 NAV Total Return as of 14Jul2021 YTD.

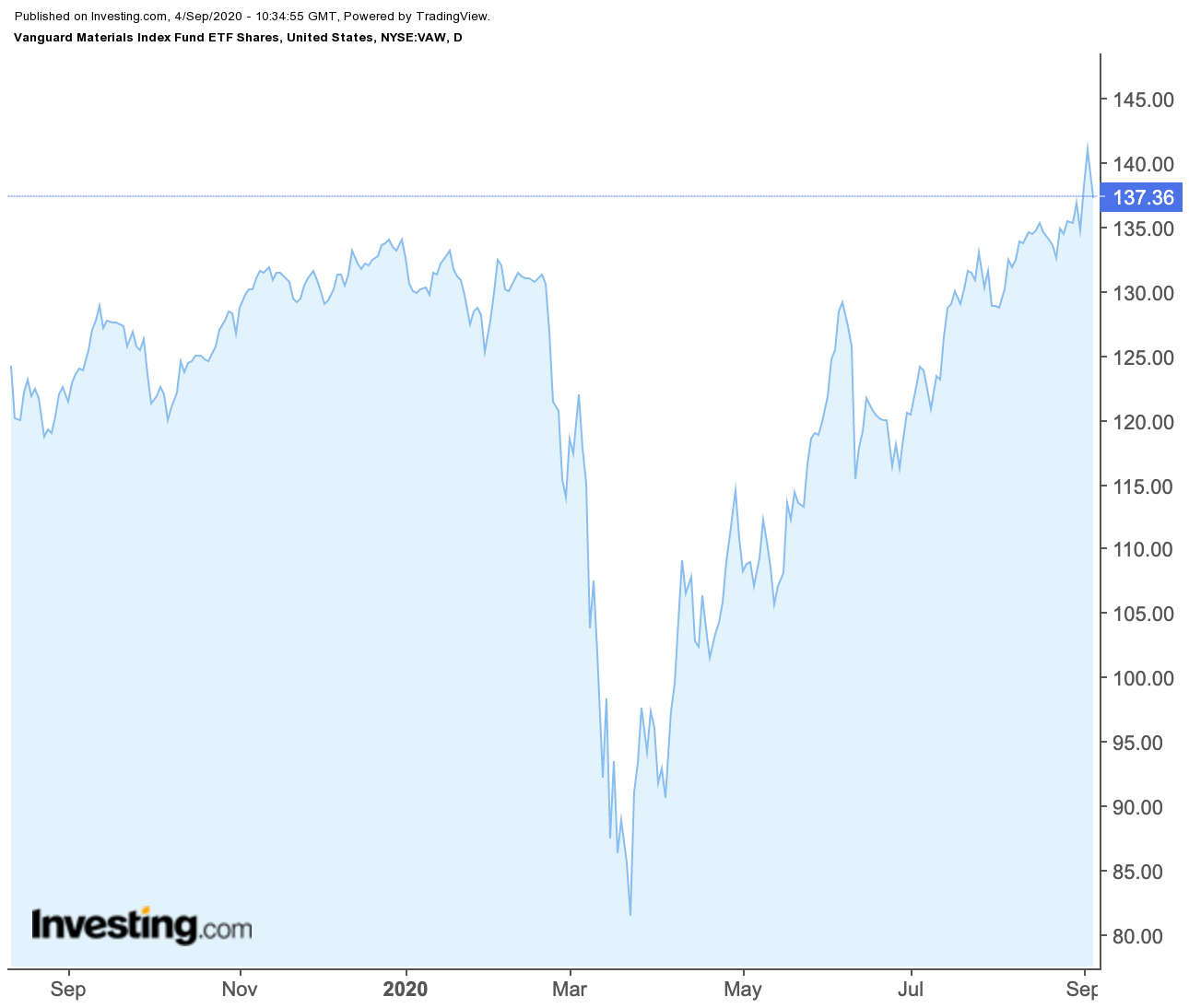

Matthew Johnston has more than 5 years writing content for Investopedia. Strong housing demand tight supplies and low rates are the perfect recipe for a rally. 77 rows ETF issuers who have ETFs with exposure to Homebuilders are ranked on certain.

The ETF Ill be reviewing today - The Direxion Daily Homebuilders. NAV as of 14Jul2021 EUR 6208. XHB PKB and ITB are the best homebuilder ETFs for Q3 2021.