Electrical Equipment Depreciation Rate

To search by asset simply type the asset name into the search box then click.

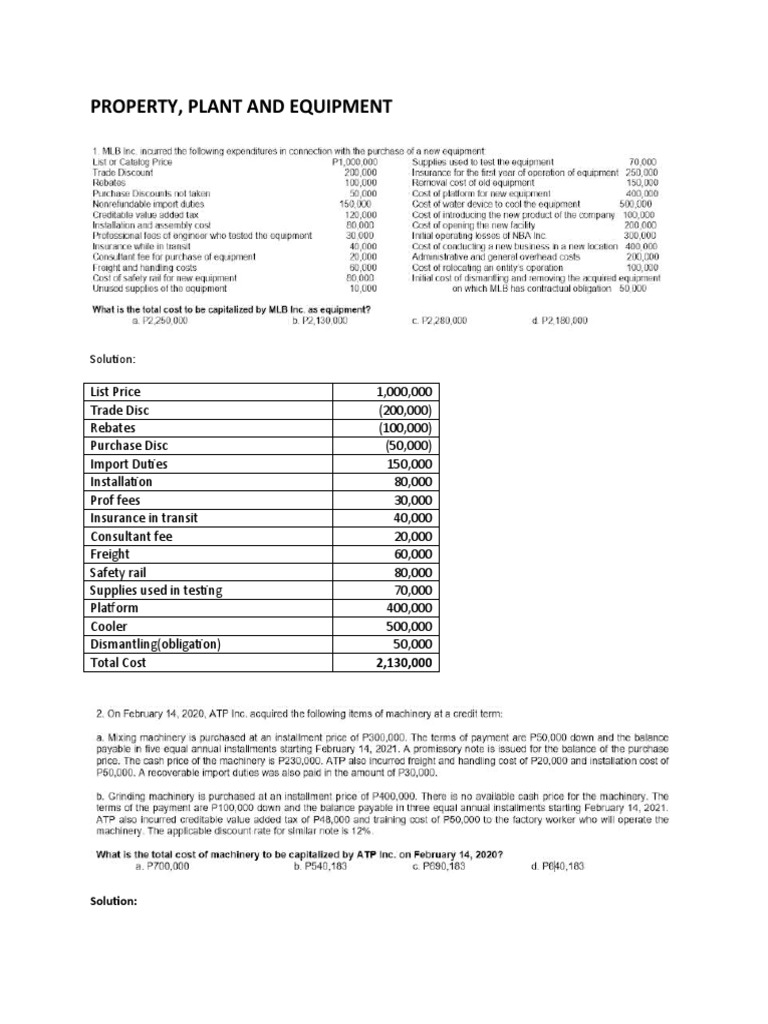

Electrical equipment depreciation rate. 5NESD means No extra shift depreciation. Thus the annual depreciation value will be 500 - 50 5 which is 90 a year over that five-year period. How to use.

Rate of depreciation shall be 40 if conditions of Rule 52 are satisfied. Any fittings furniture including electrical fittings. The AO had an opinion that lab equipment and electrical installations would not be considered as part of plant machinery used for manufacturing purpose.

Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance. Use the 1993-2005 rates for. Region to the deficient region.

20 2 Vessels ordinarily operating on inland waters not covered by sub-item 3 below. Depreciation is allowed as a deduction under section 32 of the Income Tax Act 1961. Boarding houses and hotels.

Buildings that were purchased or to be built and the relevant contract was signed prior to. In the computation of taxable income the depreciation rate as per income tax act will be allowed as deduction while depreciation as per book profit is added back. Electrical fittings include electrical wiring switches sockets other fittings and fans etc.

167 rows Electrical fittings include electrical wiring switches sockets other fittings. Station and auxiliary electrical systems within the power station. Station and auxiliary electrical systems within the power station.