Home Improvement 401k Loan

Taking a loan from a 401k permits you to borrow up to 50 of the value of your 401k a maximum of 50000.

Home improvement 401k loan. The first is if the repairs are necessary and urgent. Some plans do not allow participants to contribute to the plan while they have a loan outstanding. Yes you can borrow money from your 401k for any reason which includes funding a home improvement project.

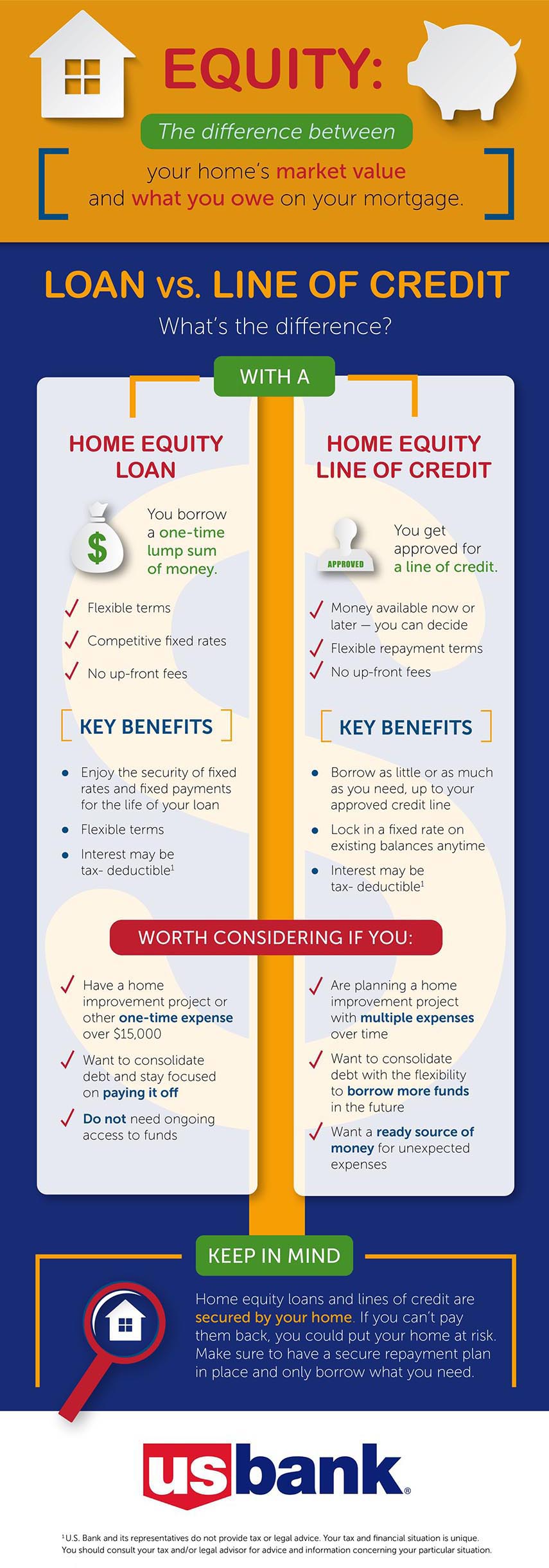

Youll also miss out on any matching contributions from your employer during that time. Another alternative is applying for a loan through a peer to peer lending company such as Lending Club. A home equity loan HEL is a type of loan in which you use the equity of your property 401k Loans For Home Improvement or a portion of the equity thereof as collateral.

It can take a bit longer to get approved for a HELOC than a home equity loan. It was a cheap way to borrow money says Ashley. Home improvement loans are unsecured personal loans offered by banks credit unions and a number of online lenders.

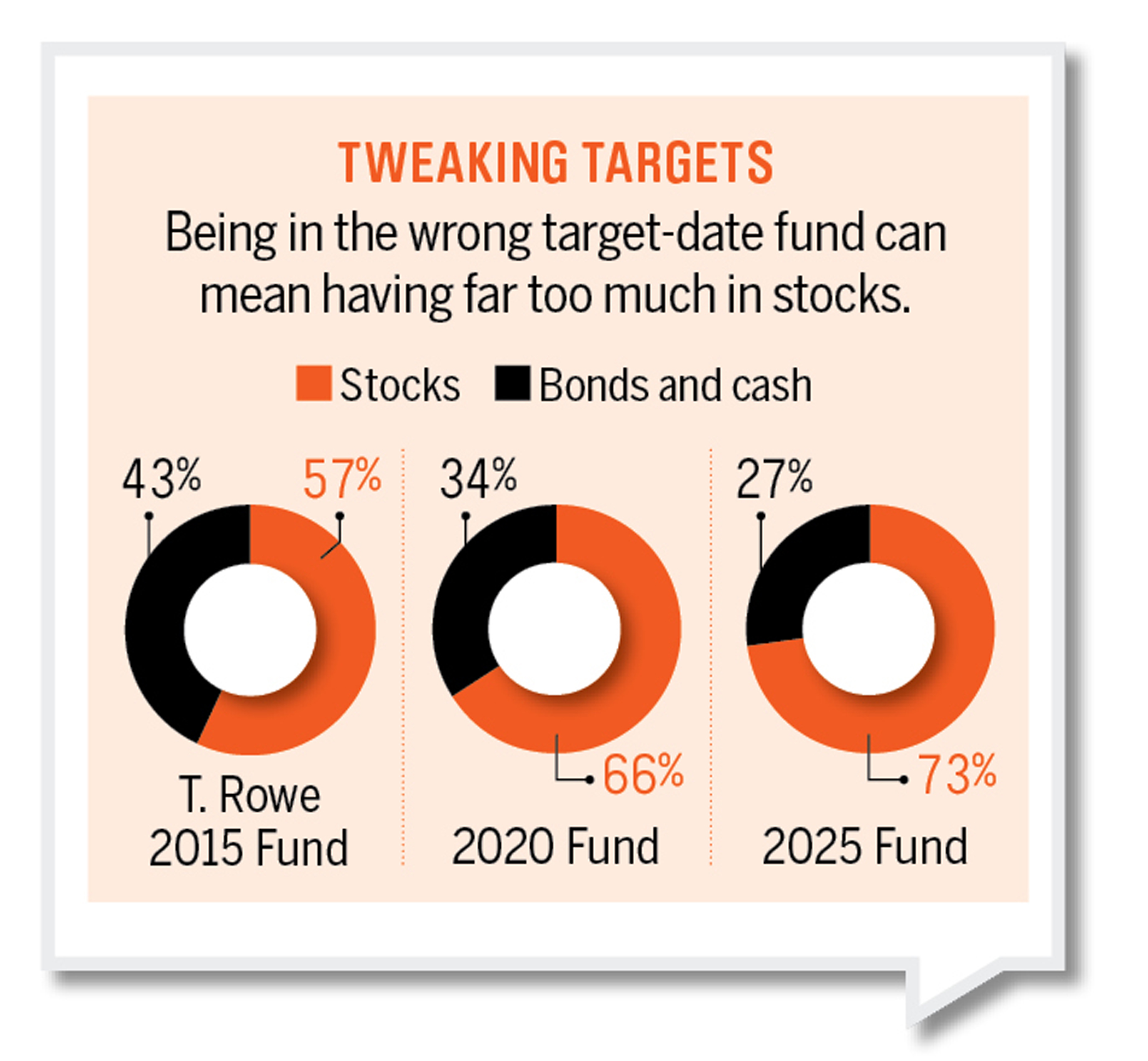

Homeowners with renovation projects more than 50000 must consider finding additional sources of funding aside from a 401k loan. Some employer 401 k plans allow you to borrow money to pay for home improvements. 3 In terms of repayment a 401 k loan must be repaid within five years.

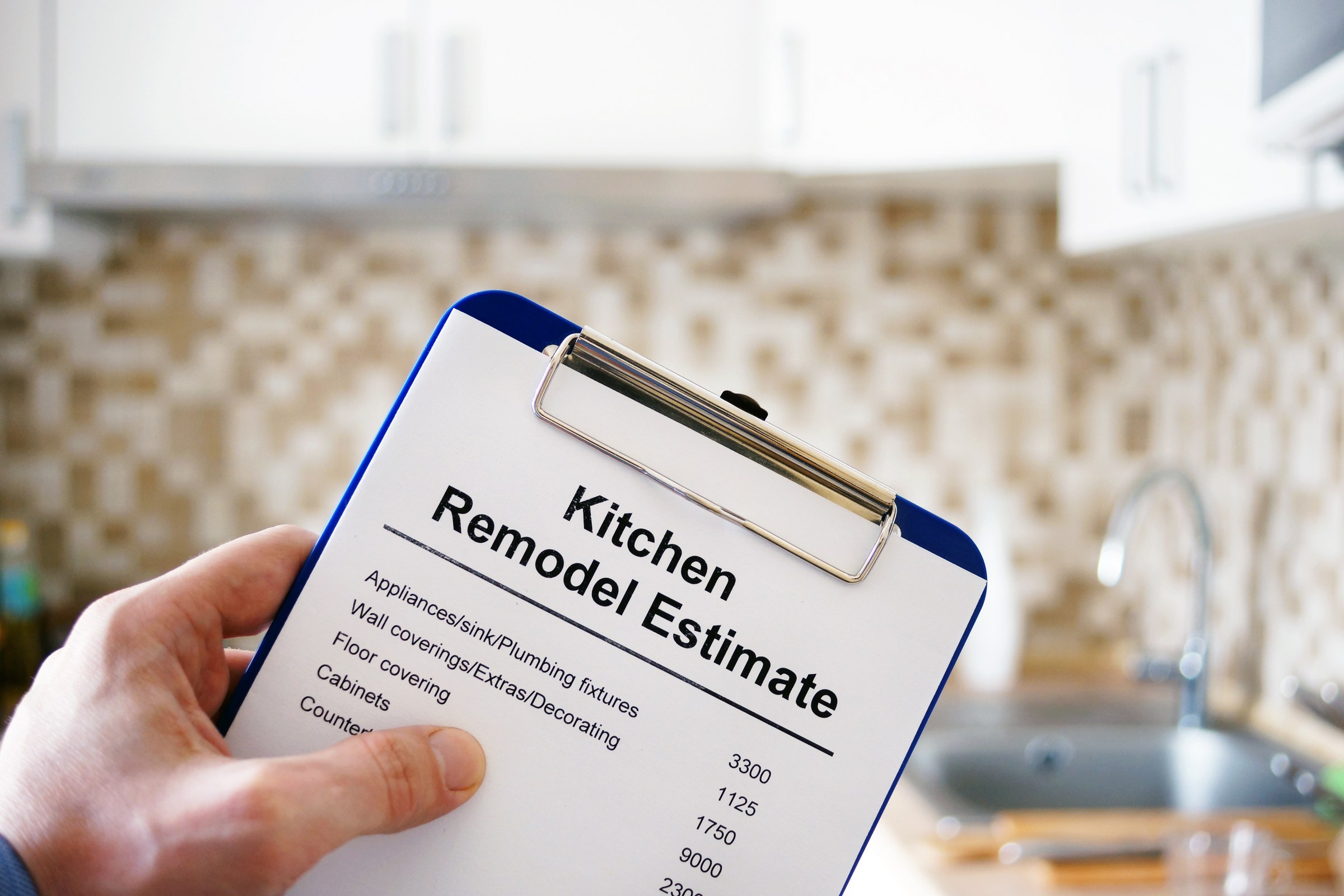

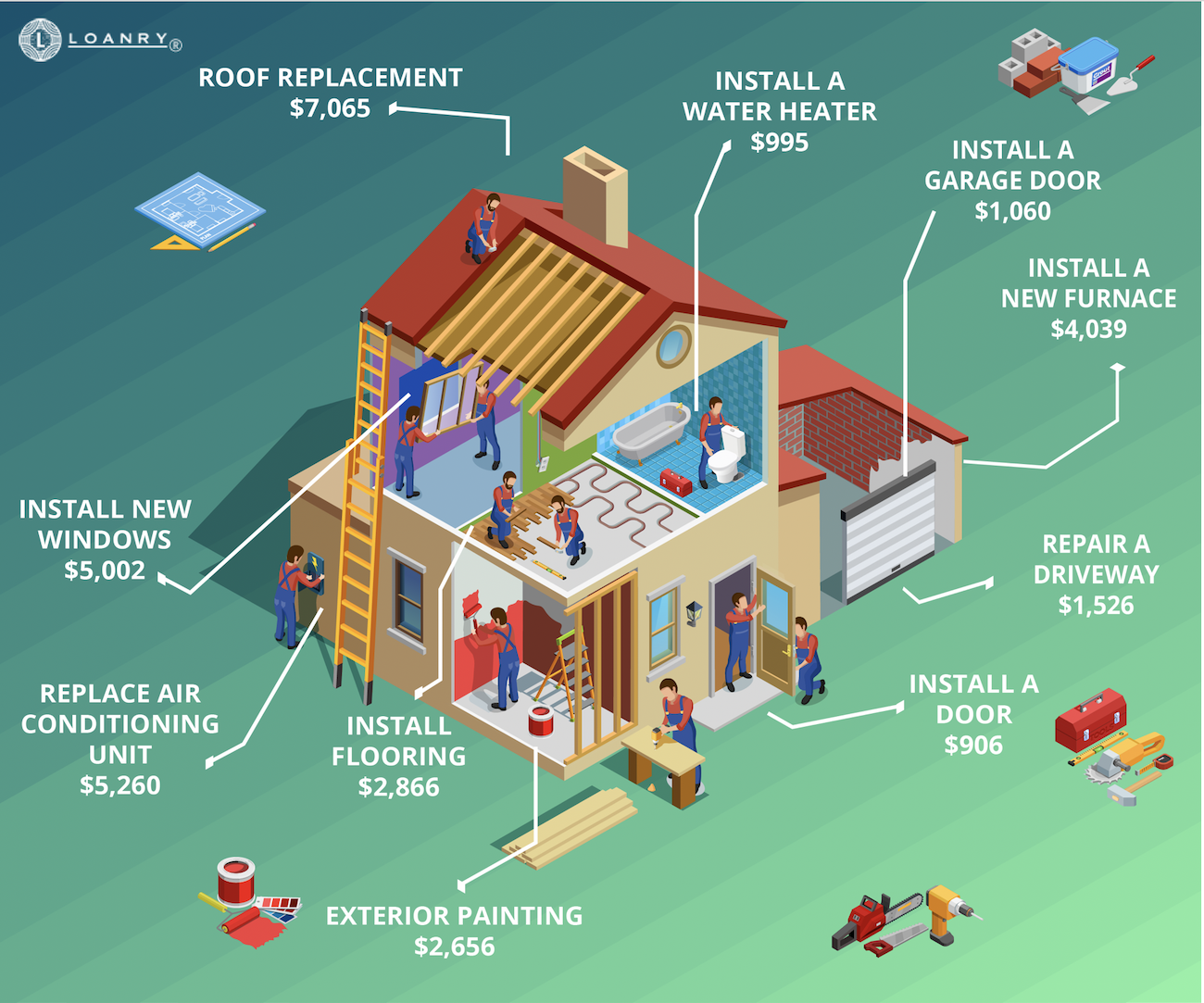

Can veterans get FHA home improvement loans. With a home improvement loan upgrades such as new kitchens roof repairs and even swimming pools may be easier to complete. Home improvement loans can be as small as 1000 or as large as 50000.

We had just purchased the. Why Choose a Home Improvement Loan. Rates are usually low and you dont have to pay fees or qualify for a loan.

/posttv-thumbnails-prod.s3.amazonaws.com/05-08-2019/t_13dbf316600744009c1120edca856109_name_renovation.jpg)

/besthomeimprovementloans-7966d88fa94b4398a1dab230c53d853a.jpg)