Household Appliances Depreciation

If an expense is for both rental use and personal use such as mortgage interest or heat for the entire house you must divide the expense between rental use and personal use.

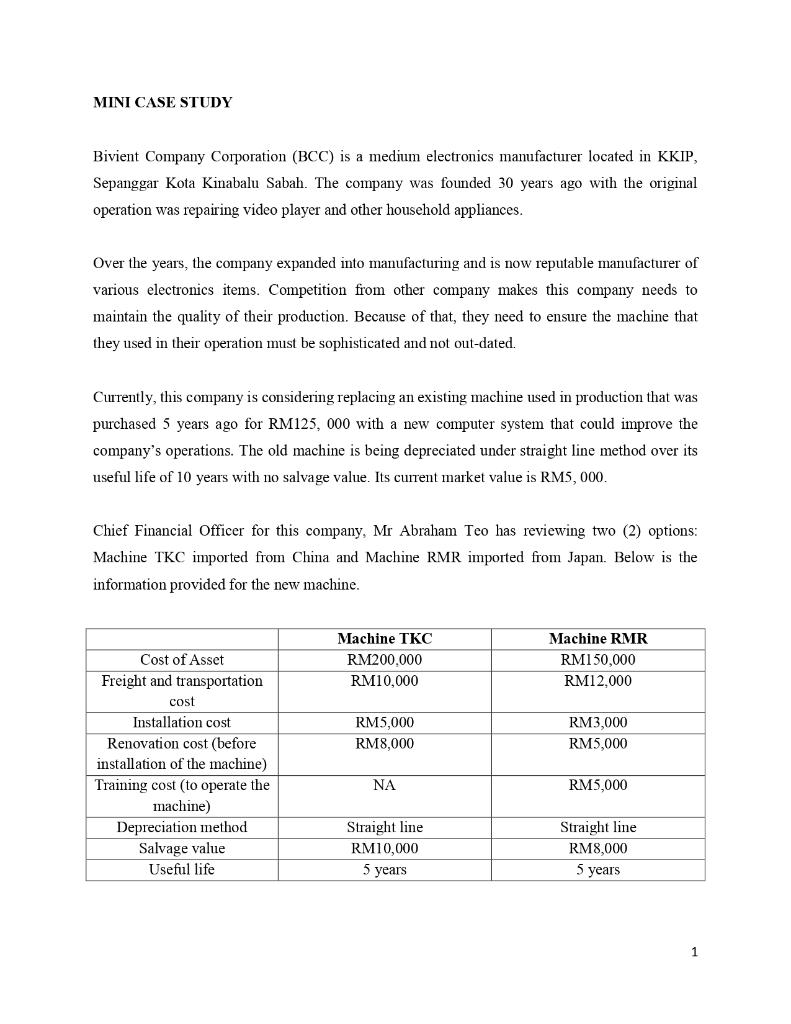

Household appliances depreciation. Ad 18 month financing on Appliance and Geek Squad purchases 599. In these cases the word is used as an accounting term and it has a slightly different meaning than the conventional meaning. Other time we can just use the annual depreciation rate which is determined by using 100 percent divided by the lifespan of a product or equipment.

So for your first year youll write off 1727. We Will Match It. Free Delivery on Major Appliance purchases 399 and up.

This class also includes appliances carpeting furniture etc used in a. This is from IRS Publication 527. This class includes computers and peripheral equipment office machinery typewriters calculators copiers etc automobiles and light trucks.

955 x 10000 500 1555. Pay With PayPal For A Fast Secure Checkout. Many systems of taxation have a specific set of rules regarding depreciation recognizing that it is a cost of doing business.

Small appliances including blenders food processors mixers and toasters 4 years. Appliances Are Tax Deductions for the Landlord Purchases of major appliances like a refrigerator carpet stove washer and dryer are all tax deductions for landlords. Appliances - Major - Stoves Ranges - Electric Depreciation Rate588 per year.

Depreciation cost Original cost of appliance salvage value lifespan of appliance. Appliances can also qualify for asset depreciation on a tax return. Your basis in the land would be 11000 10 of 110000.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19863279/Laundry_iStock-1153953176.0.jpg)